Essay

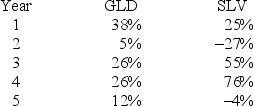

Yearly returns (rounded to the nearest percent) for GLD (a gold exchange traded fund) and SLV (a silver exchange traded fund) are reported in the following table.  (See the Excel Data File.)

(See the Excel Data File.)

A) Calculate the covariance between GLD and SLV.

B) Calculate and interpret the correlation coefficient.

Correct Answer:

Verified

a. sxy = 0.0375 =COVAR...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: In quality control settings, businesses prefer a

Q11: The arithmetic mean is the middle value

Q12: The sample data below shows the number

Q13: Which of the following is the most

Q14: The following is return data for a

Q16: Which of the following is not true

Q17: When working with grouped data, the class

Q18: A portfolio's annual total returns (in percent)

Q19: Consider a population with data values of

Q20: The coefficient of variation is a unit-free