Essay

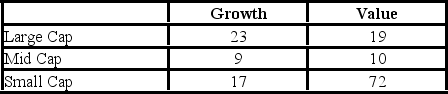

The following table shows the cross-classification of hedge funds by market capitalization (either small, mid, or large cap) and objective (either growth or value).  a. Set up the competing hypotheses to determine if market capitalization and objective are dependent.

a. Set up the competing hypotheses to determine if market capitalization and objective are dependent.

B) Calculate the value of the test statistic and determine the degrees of freedom.

C) Compute the p-value. Does the evidence suggest market capitalization and objective are dependent at the 5% significance level?

Correct Answer:

Verified

a. H0: Objective and market cap are indep...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: A fund manager wants to know if

Q28: The chi-square test of a contingency table

Q29: The following frequency distribution shows the monthly

Q30: A fund manager wants to know if

Q31: Suppose Bank of America would like to

Q33: In the following table, likely voters' preferences

Q34: A goodness-of-fit test analyzes for two qualitative

Q35: When applying the goodness-of-fit test for normality,

Q36: The following frequency distribution shows the monthly

Q37: Packaged candies have three different types of