Multiple Choice

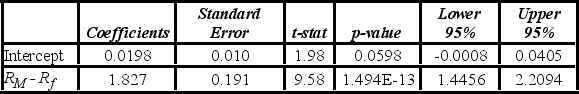

Tiffany & Co. has been the world's premier jeweler since 1837. The performance of Tiffany's stock is likely to be strongly influenced by the economy. Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period (n = 60) . The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Tiffany's return.  When testing whether the beta coefficient is significantly greater than one, the value of the test statistic is ________.

When testing whether the beta coefficient is significantly greater than one, the value of the test statistic is ________.

A) −1.98

B) 1.98

C) 4.33

D) 9.58

Correct Answer:

Verified

Correct Answer:

Verified

Q35: A sports analyst wants to exam the

Q36: The term multicollinearity refers to the condition

Q37: Tiffany & Co. has been the world's

Q38: A simple linear regression, Sales = β<sub>0</sub>

Q39: Refer to below regression results. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg"

Q41: _ plots can be used to detect

Q42: The accompanying table shows the regression results

Q43: In regression, multicollinearity is considered problematic when

Q44: If in the multiple linear model the

Q45: An economist estimates the following model: y