Essay

On January 1 2010,Max,Inc.paid $80,000 for a truck with an estimated useful life of 10 years and a $20,000 salvage value.During 2013,Max,Inc.'s truck was not running very well.

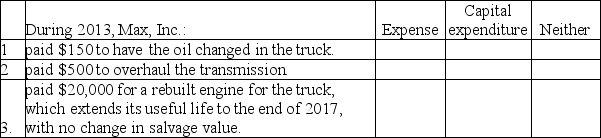

Part A: Put an X in the appropriate box to show whether each item is an expense,a capital expenditure,or neither.

Part B:

1.Straight-line depreciation expense for 2012 is

$_____________________.

2.The book value of the machine at December 31,2012 is $___________________.

3.Straight-line depreciation expense for 2013,after the major overhaul,is $__________.

Correct Answer:

Verified

Part A:  _TB5475_00

_TB5475_00

Part B:

1....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Part B:

1....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q165: Basquets,Inc.purchased land and two factories at a

Q166: Explain when a cost should be recorded

Q167: The Internal Revenue Service Code sets accounting

Q168: Tango Company purchased land and a building

Q169: Which of the statements below regarding capital

Q171: Return on assets is a ratio used

Q172: Intangible assets are depleted over their useful

Q173: Use the following selected information from Alpha

Q174: Part A: Record the effect of each

Q175: Identify each of the assets listed below