Essay

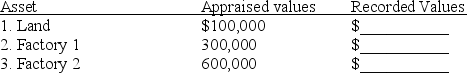

Basquets,Inc.purchased land and two factories at a total cost of $800,000.To the right of the appraised values below,show the amount Basquets should record as the cost of each asset:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q160: A loss on the sale of a

Q161: An accelerated depreciation method refers to any

Q162: When a company uses cash to purchase

Q163: On January 1,2011,Petrel Shipping Company bought equipment

Q164: On February 1, 2011, Delta Distribution Company

Q166: Explain when a cost should be recorded

Q167: The Internal Revenue Service Code sets accounting

Q168: Tango Company purchased land and a building

Q169: Which of the statements below regarding capital

Q170: On January 1 2010,Max,Inc.paid $80,000 for a