Essay

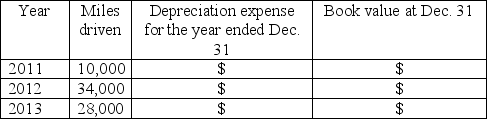

On February 1, 2011, Delta Distribution Company purchased a delivery truck that cost $30,000. The truck has an estimated useful life of 150,000 miles and an estimated salvage value of $3,000. The truck is driven 10,000; 34,000; and 28,000 miles for the years 2011, 2012, and 2013, respectively.

Required:

1. Calculate the depreciation expense per mile using the activity (units-of-production) method.

2. Use the activity method to complete the chart below: 3.Explain why long-term assets must be depreciated,rather than recorded as expenses in the period when the asset is purchased.

3.Explain why long-term assets must be depreciated,rather than recorded as expenses in the period when the asset is purchased.

4.Explain why land is NOT depreciated when other assets,such as trucks,are depreciated.

Correct Answer:

Verified

1.($30,000 - 3,000)/ 150,000 miles = $0....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q159: Team instructions: Divide the class into teams

Q160: A loss on the sale of a

Q161: An accelerated depreciation method refers to any

Q162: When a company uses cash to purchase

Q163: On January 1,2011,Petrel Shipping Company bought equipment

Q165: Basquets,Inc.purchased land and two factories at a

Q166: Explain when a cost should be recorded

Q167: The Internal Revenue Service Code sets accounting

Q168: Tango Company purchased land and a building

Q169: Which of the statements below regarding capital