Essay

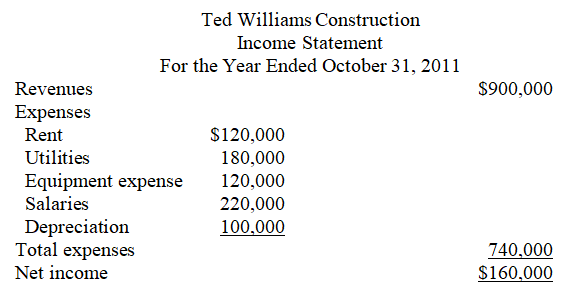

A client has asked you to review and correct the following income statement: Additional information:

Additional information:

a.A $3,500 machine tune-up was recorded as an asset.

b.The costs of buying a $120,000 piece of equipment on the last day of the fiscal year were treated as equipment expense.

c.An asset with a cost of $230,000,a 10-year useful life,and a zero salvage value was depreciated $23,000 for the full year.

d.The power and electricity costs of running a machine were treated as an expense for the year.The costs amounted to $56,000.

e.The costs of insuring a piece of equipment while it was in transit amounted to $5,000,and those costs were capitalized.

Required:

1.List any errors that you find.

2.Correct the errors and prepare another income statement.

Correct Answer:

Verified

1.Errors:

a.The $3,500 tune-up...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

a.The $3,500 tune-up...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q152: Intangible assets are amortized over their useful

Q153: On January 1,2011,Crunch Company paid $100,000 for

Q154: Which statement below best describes the meaning

Q155: All of the following account titles are

Q156: What effect does depreciating a long-term asset

Q158: On January 8,2011,Safari LLP bought three buildings

Q159: Team instructions: Divide the class into teams

Q160: A loss on the sale of a

Q161: An accelerated depreciation method refers to any

Q162: When a company uses cash to purchase