Essay

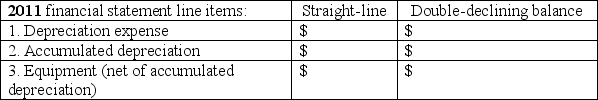

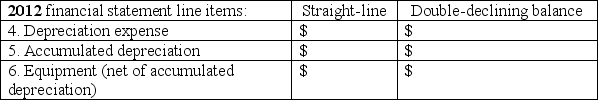

On January 1,2011,Crunch Company paid $100,000 for equipment with an estimated useful life of 5 years and no residual value.

Part A: Calculate the financial statement amounts using each of the depreciation methods below:

Part B:

Part B:

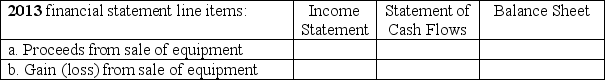

1.On January 1,2013,Crunch Company sold the equipment for $62,000 cash.Assume straight-line depreciation was used.For each financial statement line item,write in the correct amount in the column that represents the financial statement where the information is found:

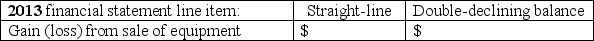

2.Show the effect if the truck had been sold for $45,000 cash.

2.Show the effect if the truck had been sold for $45,000 cash.

Correct Answer:

Verified

Part A:

_TB5475_00 Straight-line deprec...

_TB5475_00 Straight-line deprec...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q148: Able Company bought a machine on January

Q149: A machine was purchased for $100,000 in

Q150: On January 1,2011,Ace Electronics paid $400,000 cash

Q151: A major function of an internal control

Q152: Intangible assets are amortized over their useful

Q154: Which statement below best describes the meaning

Q155: All of the following account titles are

Q156: What effect does depreciating a long-term asset

Q157: A client has asked you to review

Q158: On January 8,2011,Safari LLP bought three buildings