Multiple Choice

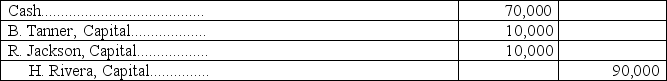

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

A) Acceptance of a new partner who invests $70,000 and receives a $20,000 bonus.

B) Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C) Addition of a partner who pays a bonus to each of the other partners.

D) Additional investment into the partnership by Tanner and Jackson.

E) Withdrawal of $10,000 each by Tanner and Jackson upon the admission of a new partner.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Mutual agency means each partner can commit

Q21: Groh and Jackson are partners.Groh's capital balance

Q60: Identify and discuss the key characteristics of

Q70: If partners devote their time and services

Q86: A partnership that has at least two

Q101: McCartney, Harris, and Hussin are dissolving their

Q104: Khalid,Dina,and James are partners with beginning-year capital

Q133: Explain the steps involved in the liquidation

Q140: A partner can be admitted into a

Q145: How are partners' investments in a partnership