Multiple Choice

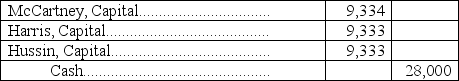

McCartney, Harris, and Hussin are dissolving their partnership.Their partnership agreement allocates income and losses equally among the partners.The current period's ending capital account balances are McCartney, $15,000, Harris, $15,000, Hussin, $(2,000) .After all the assets are sold and liabilities are paid, but before any contributions to cover any deficiencies, there is $28,000 in cash to be distributed.Hussin pays $2,000 to cover the deficiency in his account.The general journal entry to record the final distribution would be:

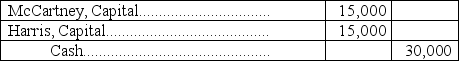

A)

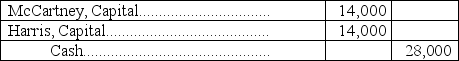

B)

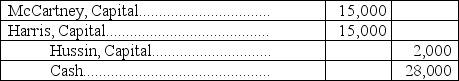

C)

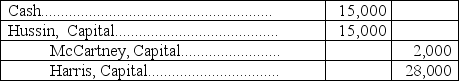

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Mutual agency means each partner can commit

Q6: When a partner leaves a partnership, the

Q21: Groh and Jackson are partners.Groh's capital balance

Q32: When a partner is unable to pay

Q66: Partners in a partnership are taxed on

Q86: A partnership that has at least two

Q96: A partnership recorded the following journal entry:

Q98: During 2013,Schmidt invested $75,000 and Baldwin invested

Q107: S.Reising contributed $48,000 in cash plus equipment

Q145: How are partners' investments in a partnership