Multiple Choice

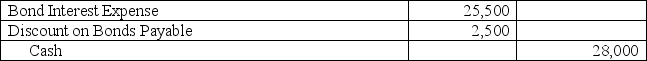

On January 1,2013,a company issued and sold an $850,000,6%,five-year bond payable and received proceeds of $825,000.Interest is payable each June 30 and December 31.The company uses the straight-line method to amortize the discount.The journal entry to record the first interest payment is:

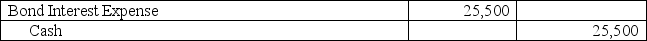

A)

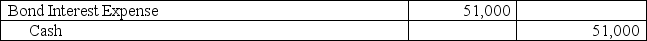

B)

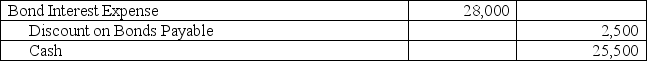

C)

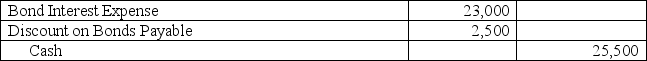

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q147: A company issued 10%,five-year bonds with a

Q148: Secured bonds:<br>A)Are also referred to as debentures.<br>B)Have

Q149: The present value of an annuity factor

Q150: The present value of an annuity can

Q153: Which of the following is true regarding

Q154: A company enters into an agreement to

Q155: A corporation issued 8% bonds with a

Q156: On January 1,2013,a company issued 10-year,10% bonds

Q157: A corporation plans to invest $1 million

Q194: The _ concept is the idea that