Essay

A company issued 10%,five-year bonds with a par value of $2,000,000,on January 1,2013.Interest is to be paid semiannually each June 30 and December 31.The bonds were sold at $2,162,290 to yield the buyers an 8% annual return.The company uses the effective interest method of amortization.

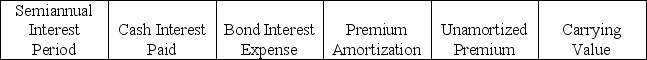

(1) Prepare an amortization table for the first two semiannual payment periods using the format shown below.

(2) Prepare the general journal entry to record the first semiannual interest payment.

(2) Prepare the general journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

(1)  _TB6947_00_TB6947_00_TB6947_00

_TB6947_00_TB6947_00_TB6947_00

6/30/...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

6/30/...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: A company has bonds outstanding with a

Q142: What is an annuity?

Q143: Operating leases are long-term or noncancelable leases

Q144: What is the debt to equity ratio

Q145: A company issued five-year,7% bonds with a

Q148: Secured bonds:<br>A)Are also referred to as debentures.<br>B)Have

Q149: The present value of an annuity factor

Q150: The present value of an annuity can

Q152: On January 1,2013,a company issued and sold

Q194: The _ concept is the idea that