Multiple Choice

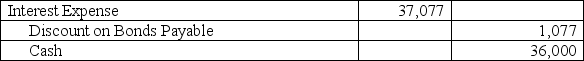

On January 1,2013,Jacob issues $800,000 of 9%,13-year bonds at a price of 96½.Six years later,on January 1,2019,Jacob retires 20% of these bonds by buying them on the open market at 105½.All interest is accounted for and paid through December 31,2018,the day before the purchase.The straight-line method is used to amortize any bond discount or premium.What is the journal entry to record the first semiannual interest payment on June 30,2013?

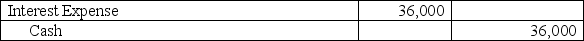

A)

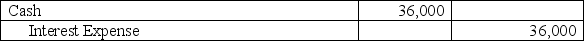

B)

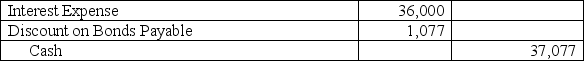

C)

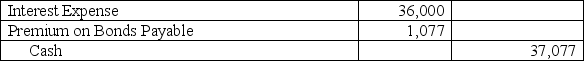

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Interest payments on bonds are determined by

Q56: A company issued 25-year,8% bonds with a

Q58: The process of systematically reducing a bond

Q59: Sinking fund bonds:<br>A)Require the issuer to set

Q63: A company purchased equipment and signed a

Q64: On January 1,2013,Timley issues $2,200,000 of 6%,12-year

Q65: A company purchased two new trucks for

Q66: The _ amortization method allocates bond interest

Q89: A pension plan is a contractual agreement

Q203: A company has 10%, 20-year bonds outstanding