Essay

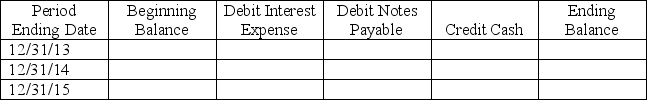

A company purchased two new trucks for a total of $250,000 on January 1,2013.The company paid $40,000 cash and gave a $210,000,three-year,8% note for the remaining balance.The note is to be paid in three annual end-of-year payments beginning December 31,2013.Assume the annual installment payments are to consist of equal amounts of principal plus accrued interest.Prepare a note amortization table using the format below.

Correct Answer:

Verified

Principle each year: $210,000/3 = $70,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Interest payments on bonds are determined by

Q48: _ bonds have an option exercisable by

Q61: On January 1,2013,Jacob issues $800,000 of 9%,13-year

Q63: A company purchased equipment and signed a

Q64: On January 1,2013,Timley issues $2,200,000 of 6%,12-year

Q66: The _ amortization method allocates bond interest

Q70: On January 1,2013,Lane issues $700,000 of 7%,15-year

Q89: A pension plan is a contractual agreement

Q105: Bonds and long-term notes are similar in

Q224: _leases are short-term or cancelable leases in