Multiple Choice

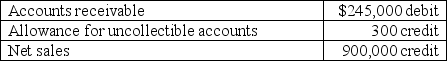

A company used the percent of sales method to determine its bad debts expense.At the end of the current year,the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit.Based on past experience,the company estimates 0.5% of credit sales to be uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit.Based on past experience,the company estimates 0.5% of credit sales to be uncollectible.What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

A) $925

B) $1,225

C) $4,200

D) $4,500

E) $45,000

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Prepare general journal entries for the following

Q9: Acme Company has credit sales of $3.10

Q11: Timmons Company had a January 1 credit

Q13: Pepsi's accounts receivable turnover was 9.9 for

Q14: Teller,a calendar year company,purchased merchandise from TechCom

Q15: A company has sales of $350,000 and

Q16: Calculate the total amount of interest that

Q17: On August 1,2013,Ace Corporation accepted a note

Q86: The accounts receivable turnover is calculated by

Q149: Crystal Products allows customers to use bank