Multiple Choice

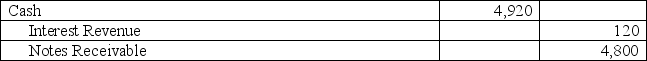

Teller,a calendar year company,purchased merchandise from TechCom on October 17 of the current year.TechCom accepted Teller's $4,800,90-day,10% note as payment.What entry should TechCom make on January 15 of the next year when the note is paid,assuming an adjusting entry for interest was made for interest on December 31?

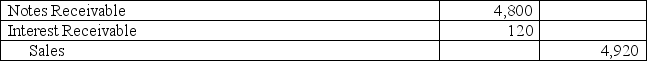

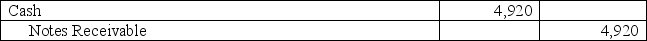

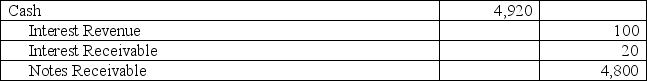

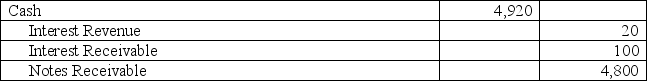

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Acme Company has credit sales of $3.10

Q11: Timmons Company had a January 1 credit

Q12: A company used the percent of sales

Q13: Pepsi's accounts receivable turnover was 9.9 for

Q15: A company has sales of $350,000 and

Q16: Calculate the total amount of interest that

Q17: On August 1,2013,Ace Corporation accepted a note

Q18: Prepare general journal entries for the following

Q19: The following information is from the annual

Q149: Crystal Products allows customers to use bank