Multiple Choice

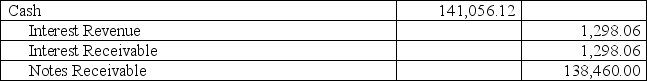

On November 15,2013,Betty Corporation accepted a note receivable in place of an outstanding accounts receivable in the amount of $138,460.The note is due in 90 days and has an interest rate of 7.5%.What is the appropriate journal entry to record at maturity?

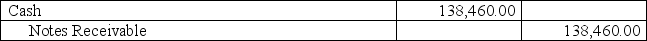

A)

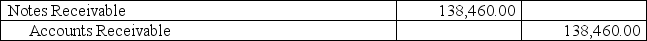

B)

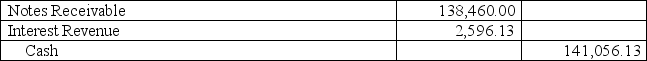

C)

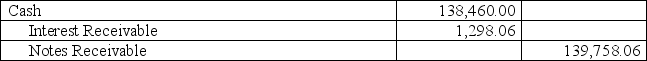

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q20: A promissory note is a written promise

Q35: The use of an allowance for bad

Q127: What is the accounts receivable turnover ratio?

Q164: Vine Company began operations on January 1,2013.During

Q165: Assume that this company's bad debts are

Q166: After adjustment,the allowance for doubtful accounts has

Q167: Corona Company has credit sales of $4.60

Q169: The aging of accounts receivable involves classifying

Q171: A payee of a note will always

Q172: At December 31 of the current year,