Short Answer

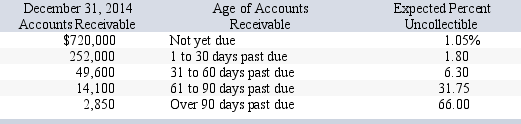

Corona Company has credit sales of $4.60 million for year 2014.The company estimates that 2% of sales will be uncollectible.On December 31,2014,the company's Allowance for Doubtful Accounts has an unadjusted credit balance of $13,164.Corona prepares a schedule of its December 31,2014,accounts receivable by age.Based on past experience,it estimates the percent of receivables in each age category that will become uncollectible.This information is summarized here:

Assuming the company used the percent of sales method determine the amount that should be recorded for bad debt expense on December 31,2014.

Assuming the company used the percent of sales method determine the amount that should be recorded for bad debt expense on December 31,2014.

Correct Answer:

Verified

$4,600,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: A promissory note is a written promise

Q127: What is the accounts receivable turnover ratio?

Q162: On August 1,2013,Ace Corporation accepted a note

Q164: Vine Company began operations on January 1,2013.During

Q165: Assume that this company's bad debts are

Q166: After adjustment,the allowance for doubtful accounts has

Q168: On November 15,2013,Betty Corporation accepted a note

Q169: The aging of accounts receivable involves classifying

Q171: A payee of a note will always

Q172: At December 31 of the current year,