Multiple Choice

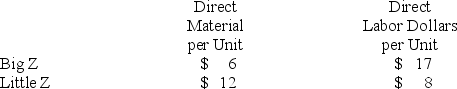

Kamper Company sells two products Big Z and Little Z.Current direct material and direct labor costs are detailed below.Next year,the company wishes to use a plantwide overhead rate with direct labor hours as its allocation base.Next year's overhead is estimated to be $475,000.The direct labor and direct materials costs are estimated to be consistent with the current year.Direct labor costs $20 per hour and the company expects to manufacture 32,000 units of Big Z and 9,000 units of Little Z next year.  What are total estimated direct labor hours for this next year?

What are total estimated direct labor hours for this next year?

A) 30,800 total DLH.

B) 616,000 total DLH.

C) 300,000 total DLH.

D) 1,025,000 total DLH.

E) 916,000 total DLH.

Correct Answer:

Verified

Correct Answer:

Verified

Q79: A company estimates that overhead costs

Q80: Activity-based costing first assigns costs to products

Q81: ABC costing might lead to:<br>A)increasing the sales

Q82: How much overhead cost will be assigned

Q83: Which of the following are advantages of

Q85: Superior Products Manufacturing identified the following data

Q86: The use of departmental overhead rates will

Q87: A company allocates $7.50 overhead to products

Q88: Overhead costs are not directly related to

Q89: A company uses activity-based costing to determine