Multiple Choice

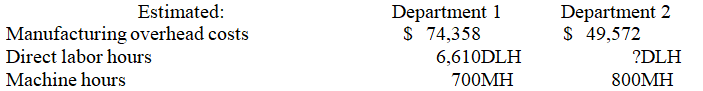

A company allocates $7.50 overhead to products based on the number of direct labor hours worked.The company uses a plantwide overhead rate with direct labor hours as the allocation base.Given the amounts below,how many direct labor hours does the company expect in department 2?

A) 9,914 DLH

B) 6,612 DLH

C) 3,109 DLH

D) 7,454 DLH

E) 16,254 DLH

Correct Answer:

Verified

Correct Answer:

Verified

Q82: How much overhead cost will be assigned

Q83: Which of the following are advantages of

Q84: Kamper Company sells two products Big Z

Q85: Superior Products Manufacturing identified the following data

Q86: The use of departmental overhead rates will

Q88: Overhead costs are not directly related to

Q89: A company uses activity-based costing to determine

Q90: Assume that the Assembly Department allocates overhead

Q91: K Company estimates that overhead costs for

Q92: What are the major advantages of using