Multiple Choice

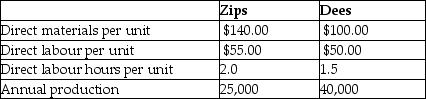

Kepple Manufacturing currently uses a traditional costing system.The company allocates overhead to its two products,Zips and Dees,using a predetermined manufacturing overhead rate based on direct labour hours.Here is data related to the company's two products:

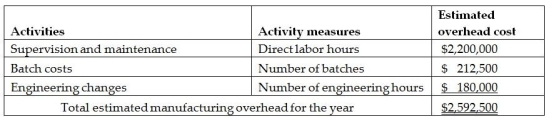

Information about the company's estimated manufacturing overhead for the year follows:

Total estimated direct labour hours for the company for the year are 110,000 hours.

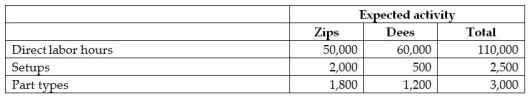

The company is evaluating whether it should use an activity-based costing system in place of its traditional costing system.Additional information about production needed for the activity-based costing system follows:

The amount of manufacturing overhead that would be allocated to one unit of Zips using the traditional costing system would be closest to

A) $35.35.

B) $23.57.

C) $47.14.

D) $32.86.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: Activity-based costing considers _ to be the

Q67: The movement of parts is considered a

Q98: The cost to design and market new

Q118: Using factory utilities would most likely be

Q136: Pittinger Company manufactures cuckoo clocks and uses

Q137: Sparrow Manufacturing manufactures small parts and uses

Q139: Franklin Corporation manufactures a wide variety of

Q141: Martin Corporation manufactures two products-Plows and Harrows.The

Q142: Heese Corporation manufactures two products-Tricycles and Wagons.The

Q178: Traditional single-allocation-base cost systems tend to over-cost