Essay

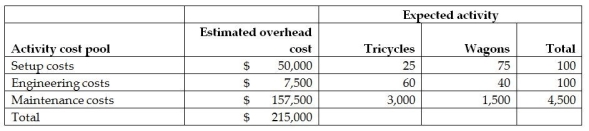

Heese Corporation manufactures two products-Tricycles and Wagons.The annual production and sales of Tricycles is 2,000 units,while 1,500 units of Wagons are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Tricycles require 1.5 direct labour hours per unit,while Wagons require 1.0 direct labour hours per unit.The total estimated overhead for the period is $215,000.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

Required:

A.Calculate the overhead per unit for a Wagon using the traditional system based on a single-wide overhead rate (use direct labour hours as the cost driver).

B.Calculate the overhead per unit for a Wagon using the activity-based costing system.

Correct Answer:

Verified

_TB1765_00_TB1765_00_TB1765_00...

_TB1765_00_TB1765_00_TB1765_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: The movement of parts is considered a

Q98: The cost to design and market new

Q118: Using factory utilities would most likely be

Q137: Sparrow Manufacturing manufactures small parts and uses

Q139: Franklin Corporation manufactures a wide variety of

Q140: Kepple Manufacturing currently uses a traditional costing

Q141: Martin Corporation manufactures two products-Plows and Harrows.The

Q147: Menno Corporation manufactures two products-Tables and Chairs.The

Q166: The cost of maintenance on the entire

Q178: Traditional single-allocation-base cost systems tend to over-cost