Multiple Choice

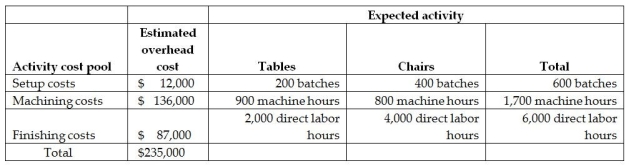

Menno Corporation manufactures two products-Tables and Chairs.The annual production and sales of Tables is 2,000 units,while 8,000 units of Chairs are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Tables require 1.0 direct labour hours per unit,while Chairs require 0.5 direct labour hours per unit.The total estimated overhead for the period is $235,000.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The overhead cost per Table using an activity-based costing system would be closest to

A) $34.00.

B) $14.50.

C) $52.50.

D) $525.00.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Jason Corporation uses activity-based costing.The company produces

Q10: Traditions Home Accessories Company manufactures pillows using

Q12: Green Bags Company manufactures cloth grocery bags

Q17: Dudley & Spahr,Attorneys at Law,provide a variety

Q27: Refined costing systems can only be used

Q49: It is easier to allocate indirect costs

Q74: Two main benefits of ABC are (1)more

Q97: Which of the following is MOST likely

Q207: Merchandising and service companies, as well as

Q229: Value-engineering is accomplished by eliminating,reducing,or simplifying all