Multiple Choice

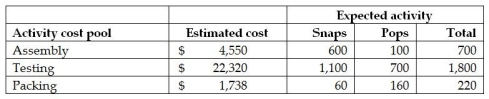

Jason Corporation uses activity-based costing.The company produces two products: Snaps and Pops.The expected annual production of Snaps is 1,000 units,while the expected annual production of Pops is 3,000 units.There are three activity cost pools: Assembly,Testing,and Packing.The estimated costs and activities for each of these three activity pools follows:

The overhead cost per unit of Pops would be closest to

A) $10.59.

B) $9.54.

C) $3.53.

D) $26.80.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Step-Up Corporation manufactures two small step ladders,Regular

Q4: Hinckley & Granger Company had the following

Q5: Bond Industries uses departmental overhead rates to

Q6: Silver Company manufactures several different products and

Q10: Traditions Home Accessories Company manufactures pillows using

Q12: Green Bags Company manufactures cloth grocery bags

Q13: Menno Corporation manufactures two products-Tables and Chairs.The

Q49: It is easier to allocate indirect costs

Q74: Two main benefits of ABC are (1)more

Q132: Facility-level activities and costs are incurred no