Essay

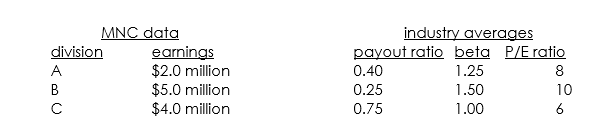

You are attempting to value MNC Inc.,a conglomerate firm with three divisions.Each division is in a different industry,and you are provided with the following information:

The corporate tax rate is 40% and all the industries are in their stable growth phases.MNC Inc.pays out 50% of its earnings as dividends and has no debt.The current annualized 6-month T-bill rate is 8%.What is your best estimate of earnings growth for MNC? Assume a market rate of return of 15%.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: If expectation theory holds then:<br>A) a flat

Q3: An annual-coupon corporate bond has a 20-year

Q4: Everything else remaining equal,the duration of a

Q5: Which of the following is an attribute

Q6: The duration of a five year maturity

Q7: Studies show that stocks with high dividend

Q8: For each of the following assets,discuss all

Q9: Your company,Solid State Gizmo,Inc.(SSG)has just been spun

Q10: Discuss (in list form)the risks associated with

Q11: You are examining the pricing of futures