Essay

On January 1,2014,Singh Company acquired an 80 percent interest in Gonzalez Company for $300,000.On January 1,2014,Gonzalez's total stockholders' equity was $375,000.The fair value and book value of Gonzalez's individual assets and liabilities were equal.

On January 2,2014,Gonzalez Company acquired a 10 percent interest in Singh Company for $50,000.On January 2,2014,Singh's total stockholders' equity was $500,000.The fair value and book value of Singh's individual assets and liabilities were equal.

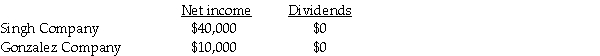

For the year ending December 31,2014,the following data is available:

The treasury stock method is used to account for the mutual stock holdings between Singh and Gonzalez.The separate net incomes do not include investment income.

Required:

1.What is Gonzalez's income from Singh for 2014?

2.What is Singh's income from Gonzalez for 2014?

3.What is the noncontrolling interest share associated with Gonzalez Company for 2014?

4.Prepare the elimination entry for Gonzalez's Investment in Singh Company.

Correct Answer:

Verified

Requirement 1

No income from Singh becau...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

No income from Singh becau...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Pacini Corporation owns an 80% interest in

Q2: Pabari Corporation owns an 80% interest in

Q3: Paik Corporation owns 80% of Acdol Corporation

Q5: Use the following information to answer the

Q6: On January 1,2014,Wrobel Company acquired a 90

Q7: On January 1,2014,Klode Corporation acquired an 80%

Q9: On January 1,2014,Adam Corporation purchased a 90%

Q10: Pablo Corporation acquired 60% of Abagia Corporation

Q11: Paine Corporation owns 90% of Achan Corporation,Achan

Q39: Use the following information to answer the