Essay

Pacini Corporation owns an 80% interest in Abdoo Corporation,acquired on January 1,2013 for $700,000 when Abdoo's stockholders' equity consisted of $600,000 of Capital Stock and $200,000 of Retained Earnings.

Abdoo Corporation acquired a 60% interest in Bach Corporation on July 1,2013 for $180,000 when Bach had Capital Stock of $200,000 and Retained Earnings of $50,000.On January 1,2014,Abdoo acquired a 70% interest in Cabo Corporation for $270,000 when Cabo had Capital Stock of $250,000 and Retained Earnings of $100,000.

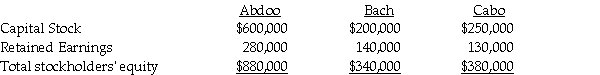

No change in outstanding stock of any of the affiliated companies has occurred since the investments were made.All cost-book value differentials are goodwill.There are no fair value/book value differentials.The stockholders' equity section of the separate balance sheets of Abdoo,Bach,and Cabo at December 31,2014 are as follows:

Required:

1.Compute the amount at which goodwill should be shown in the consolidated balance sheet of Pacini Corporation and Subsidiaries at December 31,2014.

2.Pacini and Abdoo have applied the equity method correctly.Determine the balances of the three investment accounts at December 31,2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Pabari Corporation owns an 80% interest in

Q3: Paik Corporation owns 80% of Acdol Corporation

Q5: On January 1,2014,Singh Company acquired an 80

Q5: Use the following information to answer the

Q6: On January 1,2014,Wrobel Company acquired a 90

Q7: On January 1,2014,Klode Corporation acquired an 80%

Q9: On January 1,2014,Adam Corporation purchased a 90%

Q10: Pablo Corporation acquired 60% of Abagia Corporation

Q11: Paine Corporation owns 90% of Achan Corporation,Achan

Q39: Use the following information to answer the