Essay

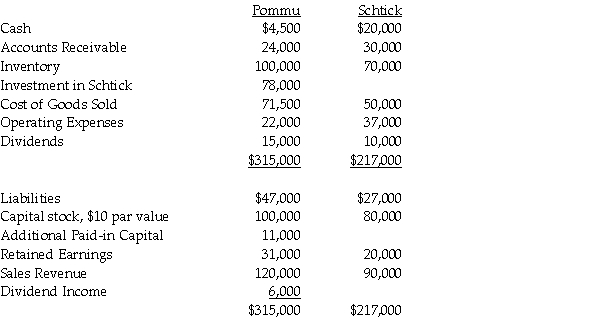

Pommu Corporation paid $78,000 for a 60% interest in Schtick Inc.on January 1,2014,when Schtick's Capital Stock was $80,000 and its Retained Earnings $20,000.The fair values of Schtick's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2014 are given below:

During 2014,Pommu made only two journal entries with respect to its investment in Schtick.On January 1,2014,it debited the Investment in Schtick account for $78,000 and on November 1,2014,it credited Dividend Income for $6,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Pommu and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Pommu and Subsidiary as of December 31,2014.

Correct Answer:

Verified

Requirement 1

Noncontroll...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Noncontroll...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: When performing a consolidation,if the balance sheet

Q8: Which of the following will be debited

Q15: Use the following information to answer question(s)

Q18: A parent company uses the equity method

Q28: On December 31,2014,Patenne Incorporated purchased 60% of

Q29: Which of the following statements is not

Q33: Parakeet Company has the following information collected

Q35: Use the following information to answer question(s)

Q36: Pennack Corporation purchased 75% of the outstanding

Q48: When preparing consolidated financial statements,which of the