Essay

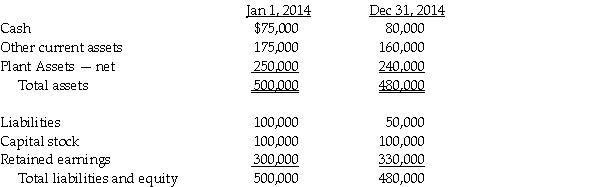

Pennack Corporation purchased 75% of the outstanding stock of Shing Corporation on January 1,2014 for $300,000 cash.At the time of the purchase,the book value and fair value of Shing's assets and liabilities were equal.Shing's balance sheet at the time of acquisition and December 31,2014 are shown below.

Shing earned $60,000 in income during the year,and paid out $30,000 in dividends.Pennack uses the equity method to account for its investment in Shing.

Requirement 1: Calculate Pennack's net income from Shing in 2014.

Requirement 2: Calculate the noncontrolling interest share in Shing's income for 2014.

Requirement 3: Calculate the balance in the Investment in Shing account reported on Pennack's separate general ledger at December 31,2014.

Requirement 4: Calculate the noncontrolling interest that will be reported on the consolidated balance sheet at December 31,2014.

Correct Answer:

Verified

Requirement 1:Shing's net income of $60,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: When performing a consolidation,if the balance sheet

Q8: Which of the following will be debited

Q15: Use the following information to answer question(s)

Q18: A parent company uses the equity method

Q28: On December 31,2014,Patenne Incorporated purchased 60% of

Q29: Which of the following statements is not

Q33: Parakeet Company has the following information collected

Q35: Pommu Corporation paid $78,000 for a 60%

Q35: Use the following information to answer question(s)

Q48: When preparing consolidated financial statements,which of the