Essay

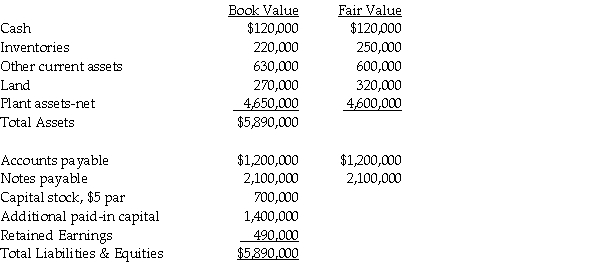

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31,2013.Parrot borrowed $2,000,000 to complete this transaction,in addition to the $640,000 cash that they paid directly.The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below.In addition,Sparrow had a patent that had a fair value of $50,000.

Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

Correct Answer:

Verified

1.General journal entry recorded by Parr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Following the accounting concept of a business

Q26: Samantha's Sporting Goods had net assets consisting

Q27: In reference to the FASB disclosure requirements

Q28: In a business combination,which of the following

Q29: Pali Corporation exchanges 200,000 shares of newly

Q31: On June 30,2013,Stampol Company ceased operations and

Q34: The balance sheets of Palisade Company and

Q35: When considering an acquisition,which of the following

Q37: A business merger differs from a business

Q46: With respect to goodwill,an impairment<br>A)will be amortized