Essay

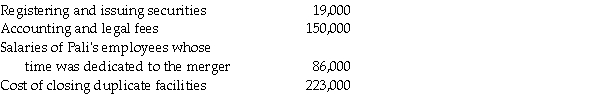

Pali Corporation exchanges 200,000 shares of newly issued $10 par value common stock with a fair market value of $40 per share for all the outstanding $5 par value common stock of Shingle Incorporated,which continues on as a legal entity.Fair value approximated book value for all assets and liabilities of Shingle.Pali paid the following costs and expenses related to the business combination:

Required: Prepare the journal entries relating to the above acquisition and payments incurred by Pali,assuming all costs were paid in cash.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Following the accounting concept of a business

Q24: Which of the following methods does the

Q26: Samantha's Sporting Goods had net assets consisting

Q27: In reference to the FASB disclosure requirements

Q28: In a business combination,which of the following

Q30: Parrot Incorporated purchased the assets and liabilities

Q31: On June 30,2013,Stampol Company ceased operations and

Q34: The balance sheets of Palisade Company and

Q37: A business merger differs from a business

Q46: With respect to goodwill,an impairment<br>A)will be amortized