Essay

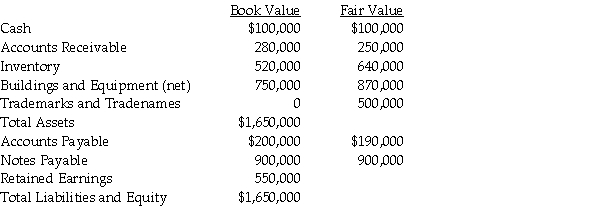

At December 31,2013,Pandora Incorporated issued 40,000 shares of its $20 par common stock for all the outstanding shares of the Sophocles Company.In addition,Pandora agreed to pay the owners of Sophocles an additional $200,000 if a specific contract achieved the profit levels that were targeted by the owners of Sophocles in their sale agreement.The fair value of this amount,with an agreed likelihood of occurrence and discounted to present value,is $160,000.In addition,Pandora paid $10,000 in stock issue costs,$40,000 in legal fees,and $48,000 to employees who were dedicated to this acquisition for the last three months of the year.Summarized balance sheet and fair value information for Sophocles immediately prior to the acquisition follows.

Required:

1.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles dissolves as a separate legal entity.

2.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $35 at the date of acquisition and Sophocles continues as a separate legal entity.

3.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles dissolves as a separate legal entity.

4.Prepare Pandora's general journal entry for the acquisition of Sophocles assuming that Pandora's stock was trading at $25 at the date of acquisition and Sophocles survives as a separate legal entity.

Correct Answer:

Verified

1.At $35 per share,assuming Sophocles di...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Use the following information to answer

Q10: Historically,much of the controversy concerning accounting requirements

Q11: Durer Inc.acquired Sea Corporation in a business

Q12: According to FASB Statement 141R,which one of

Q13: On January 2,2013 Palta Company issued 80,000

Q14: Under the provisions of FASB Statement No.141R,in

Q15: Balance sheet information for Sphinx Company at

Q20: On January 2,2013,Pilates Inc.paid $700,000 for all

Q21: According to FASB Statement No.141,liabilities assumed in

Q22: Pony acquired Spur Corporation's assets and liabilities