Essay

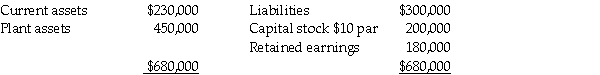

Balance sheet information for Sphinx Company at January 1,2013,is summarized as follows:

Sphinx's assets and liabilities are fairly valued except for plant assets that are undervalued by $50,000.On January 2,2013,Pyramid Corporation issues 20,000 shares of its $10 par value common stock for all of Sphinx's net assets and Sphinx is dissolved.Market quotations for the two stocks on this date are:

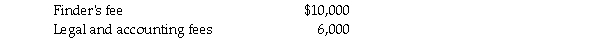

Pyramid pays the following fees and costs in connection with the combination:

Required:

1.Calculate Pyramid's investment cost of Sphinx Corporation.

2.Calculate any goodwill from the business combination.

Correct Answer:

Verified

Requiremen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Picasso Co.issued 5,000 shares of its $1

Q9: Use the following information to answer

Q10: On January 2,2013,Pilates Inc.paid $900,000 for all

Q10: Historically,much of the controversy concerning accounting requirements

Q11: Durer Inc.acquired Sea Corporation in a business

Q12: According to FASB Statement 141R,which one of

Q13: On January 2,2013 Palta Company issued 80,000

Q14: Under the provisions of FASB Statement No.141R,in

Q17: At December 31,2013,Pandora Incorporated issued 40,000 shares

Q20: On January 2,2013,Pilates Inc.paid $700,000 for all