Multiple Choice

Jesse placed equipment that cost $48,000 in service in 2015 (neither § 179 expensing nor bonus depreciation was elected) . On July 1, 2017, Jesse sold the equipment for $22,000.

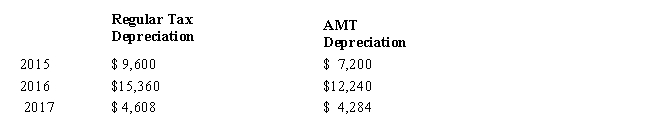

Regular tax and AMT depreciation amounts for the equipment are computed as follows.

What AMT adjustments will be required for the equipment for 2017?

A) $5,844 positive adjustment depreciation; $1,292 positive adjustment equipment sale

B) $324 positive adjustment depreciation; $(5,844) negative adjustment equipment sale

C) $648 positive adjustment depreciation; $(2,276) negative adjustment equipment sale

D) $324 positive adjustment depreciation; $0 adjustment for the equipment sale

Correct Answer:

Verified

Correct Answer:

Verified

Q31: Madge's tentative minimum tax (TMT) is $112,000.Her

Q35: If Abby's alternative minimum taxable income exceeds

Q54: If a taxpayer deducts the standard deduction

Q77: Do AMT adjustments and AMT preferences increase

Q79: Business tax credits reduce the AMT and

Q113: Dale owns and operates Dale's Emporium as

Q115: A, B and C are each single,

Q117: In calculating her 2017 taxable income, Rhonda,

Q119: Gunter, who is divorced, reports the following

Q121: In 2017, the amount of the deduction