Essay

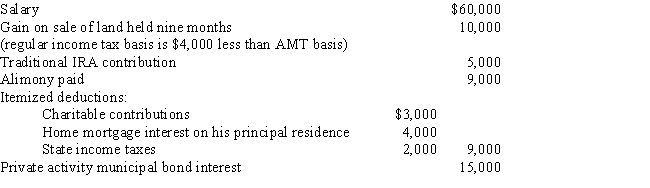

Gunter, who is divorced, reports the following items for 2017. Calculate Gunter's 2017 AMTI.

Correct Answer:

Verified

Gunter's regular income tax ta...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Gunter's regular income tax ta...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q31: Madge's tentative minimum tax (TMT) is $112,000.Her

Q35: If Abby's alternative minimum taxable income exceeds

Q44: Prior to consideration of tax credits, Clarence's

Q77: Do AMT adjustments and AMT preferences increase

Q115: A, B and C are each single,

Q116: Jesse placed equipment that cost $48,000 in

Q117: In calculating her 2017 taxable income, Rhonda,

Q121: In 2017, the amount of the deduction

Q122: Durell owns a construction company that builds

Q124: Which of the following amounts generally produce