Essay

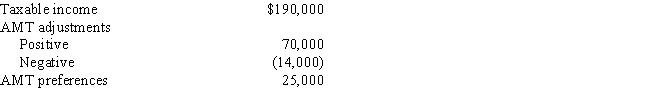

Use the following data to calculate Jolene's AMTI in 2017. Jolene itemizes deductions.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: The AMT adjustment for mining exploration and

Q19: How can interest on a private activity

Q21: Cindy, who is single and age 48,

Q25: The corporate AMT does not apply to

Q27: Arlene, who is single, reports taxable income

Q38: How can an AMT adjustment be avoided

Q41: The AMT calculated using the indirect method

Q53: Negative AMT adjustments for the current year

Q56: Kay claimed percentage depletion of $119,000 for

Q85: If the regular income tax deduction for