Essay

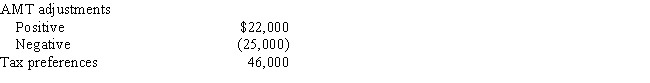

Arlene, who is single, reports taxable income for 2017 of $112,000. Calculate her alternative minimum tax, if any, given the following additional information.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: The AMT adjustment for mining exploration and

Q24: Use the following data to calculate Jolene's

Q25: The corporate AMT does not apply to

Q30: A taxpayer has a passive activity loss

Q30: For individual taxpayers, the AMT credit is

Q32: A taxpayer who expenses circulation expenditures in

Q41: The AMT calculated using the indirect method

Q53: Negative AMT adjustments for the current year

Q56: Kay claimed percentage depletion of $119,000 for

Q85: If the regular income tax deduction for