Multiple Choice

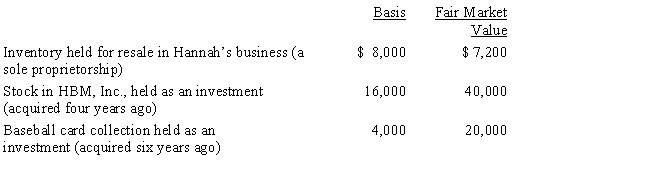

Hannah makes the following charitable donations in the current year:  The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

The HBM stock and the inventory were given to Hannah's church, and the baseball card collection was given to the United Way. Both donees promptly sold the property for the stated fair market value. Disregarding percentage limitations, Hannah's current charitable contribution deduction is:

A) $28,000.

B) $51,200.

C) $52,000.

D) $67,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The election to itemize is appropriate when

Q27: Paul, a calendar year married taxpayer, files

Q28: Richard, age 50, is employed as an

Q30: Linda borrowed $60,000 from her parents for

Q32: During 2017, Kathy, who is self-employed, paid

Q43: For all of the current year, Randy

Q44: Harry and Sally were divorced three years

Q53: Pedro's child attends a school operated by

Q82: Diane contributed a parcel of land to

Q91: Maria made significant charitable contributions of capital