Multiple Choice

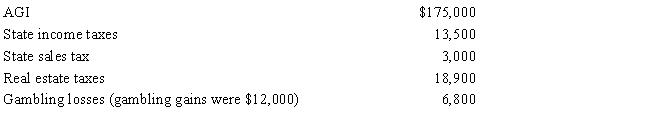

Paul, a calendar year married taxpayer, files a joint return for 2017. Information for 2017 includes the following: Paul's allowable itemized deductions for 2017 are:

A) $13,500.

B) $32,400.

C) $39,200.

D) $42,200.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: The election to itemize is appropriate when

Q23: Helen pays nursing home expenses of $3,000

Q28: Richard, age 50, is employed as an

Q30: Linda borrowed $60,000 from her parents for

Q31: Hannah makes the following charitable donations in

Q32: During 2017, Kathy, who is self-employed, paid

Q53: Pedro's child attends a school operated by

Q58: A taxpayer may not deduct the cost

Q61: Letha incurred a $1,600 prepayment penalty to

Q94: Mason, a physically handicapped individual, pays $10,000