Multiple Choice

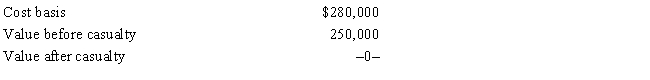

In 2017, Grant's personal residence was completely destroyed by fire. Grant was insured for 100% of his actual loss, and he received the insurance settlement. Grant had adjusted gross income, before considering the casualty item, of $30,000. Pertinent data with respect to the residence follows: What is Grant's allowable casualty loss deduction?

A) $0

B) $6,500

C) $6,900

D) $10,000

E) $80,000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: If a taxpayer sells their § 1244

Q22: The cost of depreciable property is not

Q24: Discuss the treatment of alimony paid and

Q44: Juan, married and filing jointly, had the

Q46: If a taxpayer has a net operating

Q47: A taxpayer can carry any NOL incurred

Q57: If the amount of the insurance recovery

Q66: Several years ago, John purchased 2,000 shares

Q80: The amount of partial worthlessness on a

Q86: Last year, Lucy purchased a $100,000 account