Essay

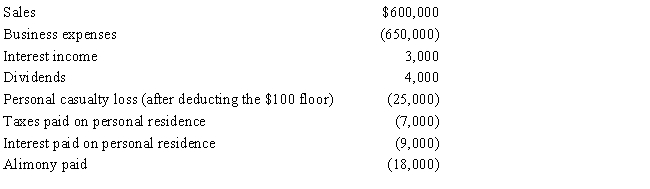

Juan, married and filing jointly, had the following income and deductions for 2017:

Juan has three dependent children. Calculate the net operating loss for 2017.

Juan has three dependent children. Calculate the net operating loss for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Discuss the tax treatment of nonreimbursed losses

Q24: Discuss the treatment of alimony paid and

Q40: In the current year, Amber Corporation has

Q41: If qualified production activities income (QPAI) cannot

Q43: Last year, Amos had AGI of $50,000.

Q44: Three years ago, Sharon loaned her sister

Q46: If a taxpayer has a net operating

Q47: A taxpayer can carry any NOL incurred

Q49: In 2017, Grant's personal residence was completely

Q86: Last year, Lucy purchased a $100,000 account