Multiple Choice

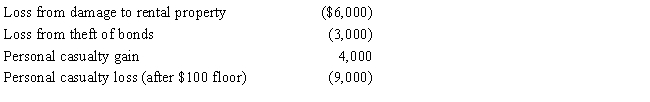

In 2017, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q37: A reimbursed employee business expense cannot create

Q43: If investment property is stolen, the amount

Q45: When a nonbusiness casualty loss is spread

Q74: If an account receivable written off during

Q90: An NOL carryforward is used in determining

Q109: Ruth, age 66, sustains a net operating

Q112: Jose, single, had the following items for

Q113: Maria, who is single, had the following

Q117: Cream, Inc.'s taxable income for the current

Q119: The domestic production activities deduction (DPAD) for