Essay

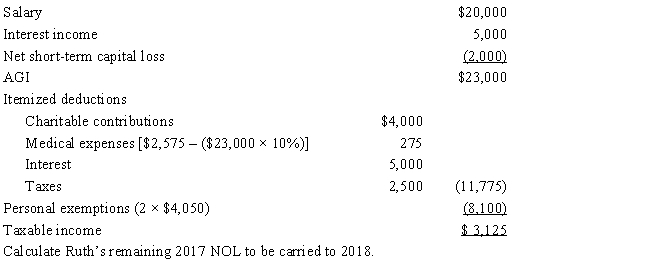

Ruth, age 66, sustains a net operating loss (NOL) of $15,000 for 2017. Because Ruth had no taxable income in 2015, the loss is carried back to 2016. For 2016, the joint income tax return of Ruth and her husband was as follows:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: The amount of a business loss cannot

Q43: If investment property is stolen, the amount

Q45: When a nonbusiness casualty loss is spread

Q62: A bond held by an investor that

Q66: What are the three methods of handling

Q104: Jim had a car accident in 2017

Q106: A taxpayer can elect to forgo the

Q112: Jose, single, had the following items for

Q113: Maria, who is single, had the following

Q114: In 2017, Morley, a single taxpayer, had