Multiple Choice

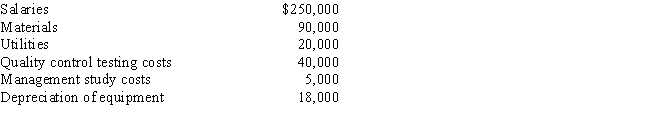

Last year, Green Corporation incurred the following expenditures in the development of a new plant process:  During the current year, benefits from the project began being realized in May. If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

During the current year, benefits from the project began being realized in May. If Green Corporation elects a 60 month deferral and amortization period, determine the amount of the deduction for the current year.

A) $48,000

B) $50,400

C) $54,667

D) $57,067

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q37: A reimbursed employee business expense cannot create

Q55: James is in the business of debt

Q74: If an account receivable written off during

Q90: An NOL carryforward is used in determining

Q98: If personal casualty gains exceed personal casualty

Q114: In 2017, Morley, a single taxpayer, had

Q117: Cream, Inc.'s taxable income for the current

Q119: The domestic production activities deduction (DPAD) for

Q123: Norm's car, which he uses 100% for

Q124: Discuss the treatment, including the carryback and