Multiple Choice

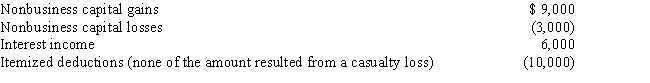

Ralph is single and has the following items for the current year:  In calculating Ralph's net operating loss, and with respect to the above amounts only, what amount must be added back to taxable income (loss) ?

In calculating Ralph's net operating loss, and with respect to the above amounts only, what amount must be added back to taxable income (loss) ?

A) $0

B) $2,000

C) $3,000

D) $4,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The limit for the domestic production activities

Q19: Wu, who is single, has the following

Q24: Red Company is a proprietorship owned by

Q26: In 2016, Robin Corporation incurred the following

Q28: A corporation which makes a loan to

Q29: Regarding research and experimental expenditures, which of

Q82: Peggy is in the business of factoring

Q91: A theft loss of investment property is

Q102: Research and experimental expenditures do not include

Q106: If a business debt previously deducted as