Essay

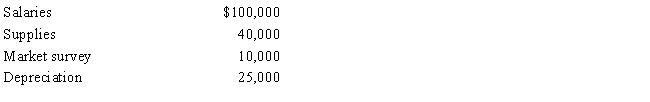

In 2016, Robin Corporation incurred the following expenditures in connection with the development of a new product:

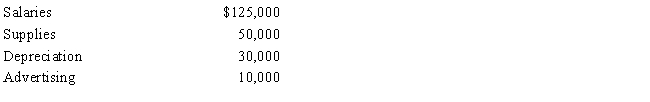

In 2017, Robin incurred the following additional expenditures in connection with the development of the product:

In October 2017, Robin began receiving benefits from the project. If Robin elects to expense research and experimental expenditures, determine the amount and year of the deduction.

In October 2017, Robin began receiving benefits from the project. If Robin elects to expense research and experimental expenditures, determine the amount and year of the deduction.

Correct Answer:

Verified

Deductibility of research and experiment...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: The cost of repairs to damaged property

Q22: Ralph is single and has the following

Q24: Red Company is a proprietorship owned by

Q28: Juanita, single and age 43, had the

Q29: Regarding research and experimental expenditures, which of

Q31: The excess of nonbusiness capital gains over

Q31: Ivory, Inc., has taxable income of $600,000

Q82: Peggy is in the business of factoring

Q91: A theft loss of investment property is

Q102: Research and experimental expenditures do not include