Essay

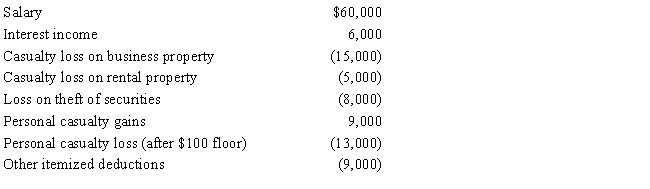

Juanita, single and age 43, had the following items for 2017:

Compute Juanita's taxable income for 2017.

Compute Juanita's taxable income for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: The cost of repairs to damaged property

Q24: Red Company is a proprietorship owned by

Q26: In 2016, Robin Corporation incurred the following

Q31: The excess of nonbusiness capital gains over

Q31: Ivory, Inc., has taxable income of $600,000

Q32: Bruce, who is single, had the following

Q53: Sally is an employee of Blue Corporation.

Q82: Peggy is in the business of factoring

Q91: A theft loss of investment property is

Q102: Research and experimental expenditures do not include