Essay

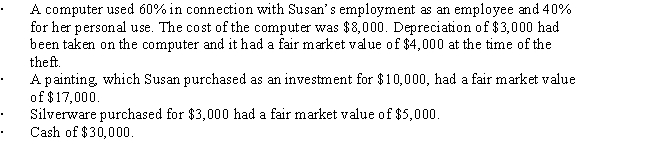

While Susan was on vacation during the current year, someone broke into her home and stole the following items:

Susan's adjusted gross income, before considering any of the above items, is $60,000.

Susan's adjusted gross income, before considering any of the above items, is $60,000.

Determine the total amount of Susan's itemized deductions resulting from the theft.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: John files a return as a single

Q5: Julie, who is single, has the following

Q6: Blue Corporation incurred the following expenses in

Q7: Mike, single, age 31, had the following

Q8: Janice, single, had the following items for

Q9: Milt, married and filing jointly, had the

Q10: Neal, single and age 37, has the

Q11: On June 2, 2016, Fred's TV Sales

Q20: A taxpayer who sustains a casualty loss

Q107: A theft of investment property can create