Essay

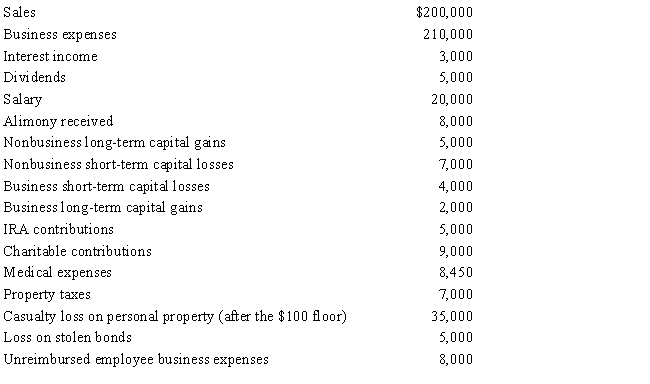

Milt, married and filing jointly, had the following items for 2017:

Milt has two dependent children. If Milt and his wife file a joint return, compute their net operating loss for 2017.

Milt has two dependent children. If Milt and his wife file a joint return, compute their net operating loss for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: While Susan was on vacation during the

Q5: Julie, who is single, has the following

Q6: Blue Corporation incurred the following expenses in

Q7: Mike, single, age 31, had the following

Q8: Janice, single, had the following items for

Q10: Neal, single and age 37, has the

Q11: On June 2, 2016, Fred's TV Sales

Q12: When a net operating loss is carried

Q13: Alicia was involved in an automobile accident

Q14: Discuss the effect of alimony in computing