Multiple Choice

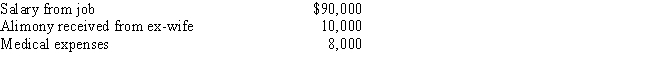

Sammy, a calendar year cash basis taxpayer who is age 66, has the following transactions in 2017:  Based on this information, Sammy has:

Based on this information, Sammy has:

A) AGI of $90,000.

B) AGI of $95,000.

C) AGI of $99,500.

D) Deduction for medical expenses of $0.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Ordinary and necessary business expenses, other than

Q22: Describe the circumstances under which a taxpayer

Q54: If an activity involves horses, a profit

Q55: Under the "one-year rule" for the current

Q57: Which of the following is correct?<br>A) A

Q58: Which of the following is not deductible?<br>A)Moving

Q61: Petal, Inc. is an accrual basis taxpayer.

Q63: Cory incurred and paid the following expenses:

Q140: Bobby operates a drug-trafficking business. Because he

Q145: Discuss the application of the "one-year rule"